Fondazione Cariplo’s grantmaking aggregated to €144 million in 2013

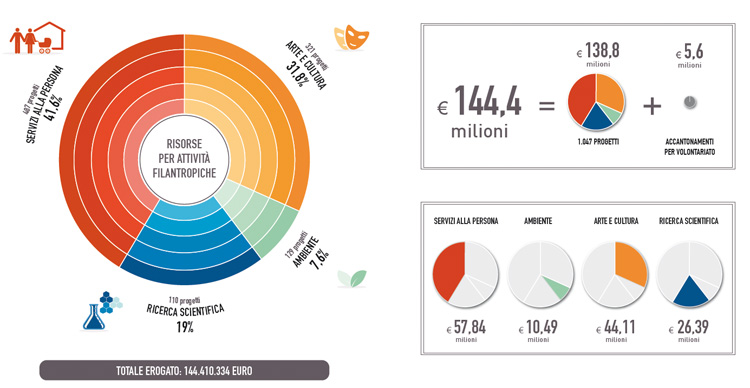

Fondazione Cariplo’s Steering Board unanimously approved the 2013 annual financial statements and resolved to transfer management of the Foundation’s stake in Intesa Sanpaolo SpA to Quaestio Capital Management. In 2013, the Foundation’s grantmaking aggregated to €144.4 million (€138.8 million supporting 1,047 projects + €5.6 million set aside for volunteer work). The increase in net assets topped €209 million, marked-to-market net worth after grantmaking was up over 6.6% and the grant stabilization reserve exceeded €200 million.

Analysis by program areas shows the Environment area received €10.49 million for 129 projects (7.6 %), Arts & Culture €44.11 million for 487 projects (31.8%), Scientific Research €26.39 million for 110 projects (19.0%) and Social & Human Services €57.84 million for 321 projects (41.6 %) including projects funded through the 15 Community Foundations that Fondazione Cariplo helped establish in the various provinces.

2013 grantmaking was aligned with commitments made for future years. In fact, last November the Foundation’s Steering Board approved the budget for its philanthropic activities until 2016 indicating stable grantmaking at around €145 million. In the coming months, the Foundation’s areas of focus will include community-based welfare and social innovation, youth education and employment in farming and manufacturing.

“The Foundation keeps its philanthropic activities steady – said Giuseppe Guzzetti, President of Fondazione Cariplo - with a strong focus on Human & Social Services that are a priority of our times, without overlooking our other program areas: Arts & Culture, Scientific Research, the Environment. In addition Fondazione Cariplo further increased the value of its assets.”

In addition to the significant grantmaking results reported, today’s meeting of the Foundation’s Steering Board set a new milestone in the journey the Foundation started long ago to diversify its assets whose marked-to-market value at December 31, 2013 was €7.198 billion (ndt. meglio scrivere €7.2 billion). The Foundation resolved to assign management of its stake in Intesa Sanpaolo (4.948%) and related financial risks to Quaestio Capital Management Sgr while keeping ownership thereof (dividends and voting rights).

The transaction – continued President Guzzetti – “is a virtuous one in different respects. Financially, as it allows the Foundation to optimize returns on investments over time and have more funds to support its philanthropic activities. Institutionally, as it does not affect our relationship with the bank, whose management we fully trust also in relation to the recently approved business plan. I am certain the people responsible for implementing the business plan (Giovanni Bazoli, Gian Maria Gros Pietro and Carlo Messina) will do it at best, as always.”